Once the artificially inflated stock opens, traders scramble to get out and professionals scramble to fill orders from retail investors at these artificially inflated levels. Once the market opens, professionals fill the orders of the retail investors from their inventory that they had accumulated over the past two days.

To understand this concept further, please refer to our previous blog about types of gaps. The green wide range bar/s indicate lots of people are going long and that there is a lot of buying pressure driving the price higher. The setup on the daily chart is simple: the trader must stock up for 1 to 2 days and for those days to be green wide range bars 1 big bar up is still acceptable.

Trading fill the gap plus#

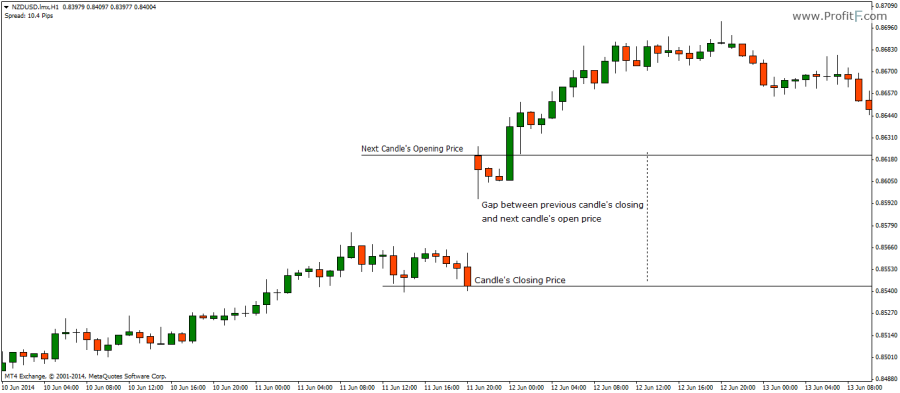

This is a plus not a must, meaning gap fade and fills occur on a regular basis even without weekly resistance and the setup is still viable. The gap fade and fill works best when the stock you’re looking to trade has been rallying up to an area of weekly resistance as shown on the inside in the example above. These imbalances are created by differences in access by various market participants most specifically between professionals/institutions and novices/retail investors. Gaps are created when there is an imbalance in buying and selling pressure in a stock in the pre and post-market. Gaps may materialize when headlines cause market fundamentals to change rapidly during hours when markets are typically closed for instance, the result of an earnings call after-hours. A gap is the area discontinuity in a security’s price chart. Gapping occurs when the price of a stock, or another asset, opens above or below the previous day’s close with no trading activity in between. On some occasions, this can grow into a swing trade, meaning some gap trades may have up to 10 days of follow-through. The pattern itself is created on the daily chart, but the trading opportunity is intraday. Traders might not know which way the stock is going to gap, but we do know that there’s going to be a gap generated by the earnings results. They occur most often during earnings season because they coincide with the day a company will declare its earnings. These setups are predictable because you know exactly when they’re going to happen each day right on the open or shortly thereafter. Gaps and gap trading setups are some of the most reliable and predictable trading setups found in short-term trading.

0 kommentar(er)

0 kommentar(er)